Until You Start Budgeting Emotionally, You Won't Stop Spending Emotionally

Why "Impulsive You" doesn't care about your latest budget spreadsheet and how to get them in line

How We (Conventionally) Think About Budgets

There are a lot of ways to set up a budget. Online tools. Spreadsheets. Stacks of envelopes. A simple yellow notepad. We’ve tried so many methods to manage our household budget over the years. Regardless of the tool, logically most budgets work the same way - as an allocation of income to some ratio of needs, wants, and savings. For example, a 50/30/20 ratio for income allocation might look like this:

50% allocated to needs (Rent, Utilities, Transportation, etc.)

30% allocated to wants (Vacations, Movies, Drinks / Eating Out)

20% allocated to savings (401k, IRA, Taxable Investments)

Budgets, done well, can really help keep spending under control while saving for the future. Budgets, done poorly, feel like No Factories where life’s joy and spontaneity go to die.

“No Factories” Are Created By “Sensible You”

You’ve done your homework. You’ve researched all the best budgeting software and you have read up on the optimal allocation ratio to meet your savings goals. You’ve painstakingly created a highly detailed spreadsheet with dozens of categories to track every penny. You take a sip of coffee and lean back to survey the beauty of life expressed in neatly formatted rows, pie charts, and pivot tables.

“Well done, Sensible You. Such an orderly and pragmatic life you have planned for us!”

Thank you! Um, who are you?

“Oh, I’m also you! If I may make one tiny observation though? Sensibly created budgets require, well… sensible day-to-day decisions about what you, er… we spend our money on.”

And?

“And you aren’t always in charge. There are times when you, er… we are, emotionally, a hot mess.”

Budgeting Is Simple, But Not Easy

Our Sensible Selves think that we’re always rational, that we would never buy a new jacket when there are insufficient funds in our clothing budget. But to our Impulsive Selves, the new jacket is not some carefully budgeted want or need. The new jacket is retail therapy; a small boost to our dopamine levels to soothe our anxiety, depression, boredom, and any number of insecurities swirling around in our broken hearts and minds.

Budgeting emotionally means tearing down the facade of our perfect, sensible selves and acknowledging our flaws. I advocate for a budget category called Retail Therapy because, as a card-carrying member of the Royal Hot Mess Society, I know we can potentially spend a lot of money on things that we neither need nor want.

It’s important to separately track impulsive, emotionally-driven spending to understand if it’s a problem. Without a category for retail therapy, emotional spending decisions are hidden inside our otherwise healthy needs and wants. They elude our attention and are more difficult to identify, understand, and tackle head-on.

Why The Big Three Should Be The Big Four

The FI community rightly focuses on The Big Three in order to get our budget under control: Housing, Transportation, & Food. If we just optimize these three categories, we can accelerate our savings rate and path to financial independence.

Deciding to downsize our house, not buying a new car every two years, and learning to cook delicious meals at home are not easy asks. These strategies demand a lot of self-work to realign our values away from status and towards wealth. But the house and car are infrequent, albeit very big, decisions that don’t challenge our willpower on a daily basis.

Retail therapy, on the other hand, is a byproduct of our broken hearts and minds and there are entire business models designed to exploit these moments of weakness every day. Watch a few 2 AM infomercials and you’ll see what I mean.

In the absence of healthy levels of dopamine and serotonin in our brains, our budget is vulnerable as we succumb to retail therapy. On our path to wealth, it doesn’t matter if we’ve mastered the big three - living rent-free in a downsized condo, driving a six-year-old Prius and eating ramen every night - if we continue to impulsively buy $300 jackets when things aren’t going well with our partner or job.

Overcoming Those Things That Keep Us Poor

To overcome a need for status, you have to find your community. You have to find like-minded people who also think it’s weird to spend $50,000 on a car when you only make $70,000 in income. Once you find your people, you no longer feel isolated for living like weirdos or pressured to keep up with your high-spending neighbors.

To overcome a need for retail therapy, you have to find yourself, and that can be a very personal journey. As president of the Royal Hot Mess Society, I am still fighting my own battles to consistently do the kind of self-care that I know will increase my levels of happy hormones: a proper diet and exercise, meditation, and getting off the couch for activities that I enjoy.

We try to minimize retail therapy in our home. We try to avoid emotionally spending on things that we neither need nor want for the purpose of short-term happiness. And we forgive ourselves when we do because this is hard work and humans are less of “a rational people” than we are “a rationalizing people.”

Spend Sensibly, But Budget Emotionally

While we don’t like to spend emotionally, we absolutely like to budget emotionally. So how do we approach budgets and spending in our household? Well, like weirdos of course.

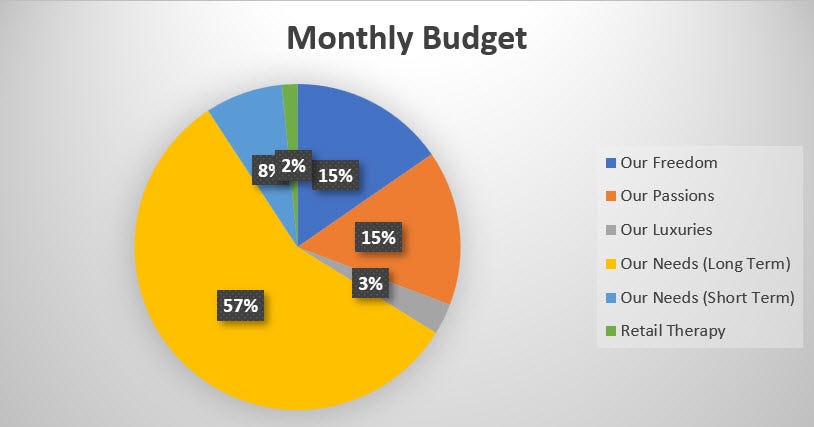

We mentioned creating a category for Retail Therapy so that we can properly see the emotionally-spendy elephant when he enters the room. We have five additional high-level categories in our budget for a typical month.

Our Freedom (~15% of our after-tax income) - The more boring way to say this is Savings and Investments. But we budget emotionally and words matter. This is no mere savings. This is our freedom, our working years refunded to us in time currency to do as we wish in future years. If we factor in pre-tax dollars, investment in our freedom approaches 40% of our total income.

Our Passions (~15% of our after-tax income) - These are buckets of money for our passions. This is budgeting emotionally for those things most important in our lives today - if we could spend every dollar here, we would. I break this category down later in this post.

Our Luxuries (~3% of our after-tax income) - These are little recurring splurges; usually subscriptions that we enjoy (i.e. Netflix or Disney+). These are things we can quash at any time, but they bring us value and don’t cost a lot so we keep them.

Our Needs (Long Term) (~57% of our after-tax income) - This category contains buckets for auto and home insurance & maintenance, fuel, utilities, taxes, groceries and hygiene, cellphones, and more. These are costs we will typically always have to pay.

Our Needs (Short Term) (~8% of our after-tax income) - These are discretionary costs that aren’t permanent but add value to our busy lives today. Convenience services like lawn care and house cleaning; as well as, things like term life insurance (we will eventually self-insure).

We spend a lot of time trying to optimize Our Needs (Long Term) so that more money can flow into Our Freedom and Our Passions. Our Needs tend to be emotionless spending (such as a water or electric bill), so cutting costs there doesn’t really feel like deprivation.

Things We Are Passionate About (Sometimes It’s a Hot Dog)

I’ve written in the past about how time is our most valuable asset, so it should come as no surprise that the first two items in the Our Passions category are Quality Time With Family and Quality Time With Friends.

We are also passionate about traveling and experiencing new cultures, we are lifelong learners, and we like to find ways to give back to our community.

Our quality time buckets within our passions category are admittedly vague, and you might wonder what kinds of expenses go in here. The answer is almost anything. The context of the expense is critical. To illustrate why let’s examine A Tale of Two Hot Dogs.

Hot Dog One was purchased on the way home from an errand. I knew I would have dinner as soon as I got home, but a craving came over me and the hot dog stand was right there. So I caved.

Hot Dog Two was purchased at the exact same location where I was meeting up with a friend that I hadn’t seen in a while for some great conversation.

Hot Dog One emotionally feels impulsive, and I would likely classify that expense under Retail Therapy. I clearly need help if I’m downing hot dogs on the sly just before dinner.

Hot Dog Two emotionally feels like reconnecting with a good friend, and I would classify that expense under Quality Time With Friends.

So we have the exact same item classified in two different ways depending on the context in which it was purchased. A generic “Eating Out” category wouldn’t properly capture the emotion behind either one of those events.

Emotional Budgets Help Us Overcome Impulsive Spending

When we receive money, via income or investments, we quickly give every dollar a job. We allocate money to any needs that are not funded yet, and any money left over is distributed among our freedom and passion buckets. We only budget with the money we have on hand, and we don’t let money languish unallocated. Unallocated money lacks an emotional anchor and becomes fertile soil for our Impulsive Selves. “Hey, that money isn’t doing anything. Why can’t I use it?”

We use emotional words and phrases like freedom, passion, and quality time with friends and family because they remind us that life is to be lived. They remind us of the emotions behind their existence. They embolden us to fiercely protect those dollars and never surrender them to impulse.

Several weeks ago, my family was talking about an impromptu trip to Ikea to get some shelving for my daughter’s closet. Years ago, we would have come home that afternoon with a new shelving system, along with various other “can’t live without” items from this retail labyrinth. But this time, we paused.

“Please just look at the budget,” I said. “Every dollar this month already has a job. If we want new shelves, then someone needs to tell me which dollars need to change jobs.”

This forced us to evaluate whether we wanted to pinch money from our travel savings or maybe from money set aside for an upcoming visit with family who we haven’t seen in more than a year. Since we budgeted emotionally in favor of those things we are most passionate about, it was an easy decision to postpone the shelving purchase.

Why was it an easy decision this time? Because in the past, boring and pragmatic budgets were created by Sensible Me. And Sensible Me doesn’t stand a chance against Impulsive Me.

But when we budgeted emotionally, we invoked something that felt more primal. A bigger beast if you will, molded from worries about our legacy, deeply-held desires about the second act of our lives, and perhaps some level of acceptance of our mortality and time left on this earth.

Our budget has magic weaved into it that Impulsive Me lacks the strength and stamina to break. And a big, furry emotional beast dutifully guarding our hard-earned dollars against all manner of impulsive imps.

This makes compassionate sense. Love it. Thanks, Allen!

Awesome, Allen! I loved reading your elaboration on your approach to budgeting and categorizing purchases. I remember your sharing about it on the car ride and it really struck a chord with me. As another member of the Royal Hot Mess Society, I love this way of considering and not judging ourselves for being R.H. Messes but taking that into account when planning. :)