Three Things Boldin Shows Us That Our Custom Retirement Spreadsheet Doesn't

A look at Boldin (formerly New Retirement) as a replacement for our DIY spreadsheet.

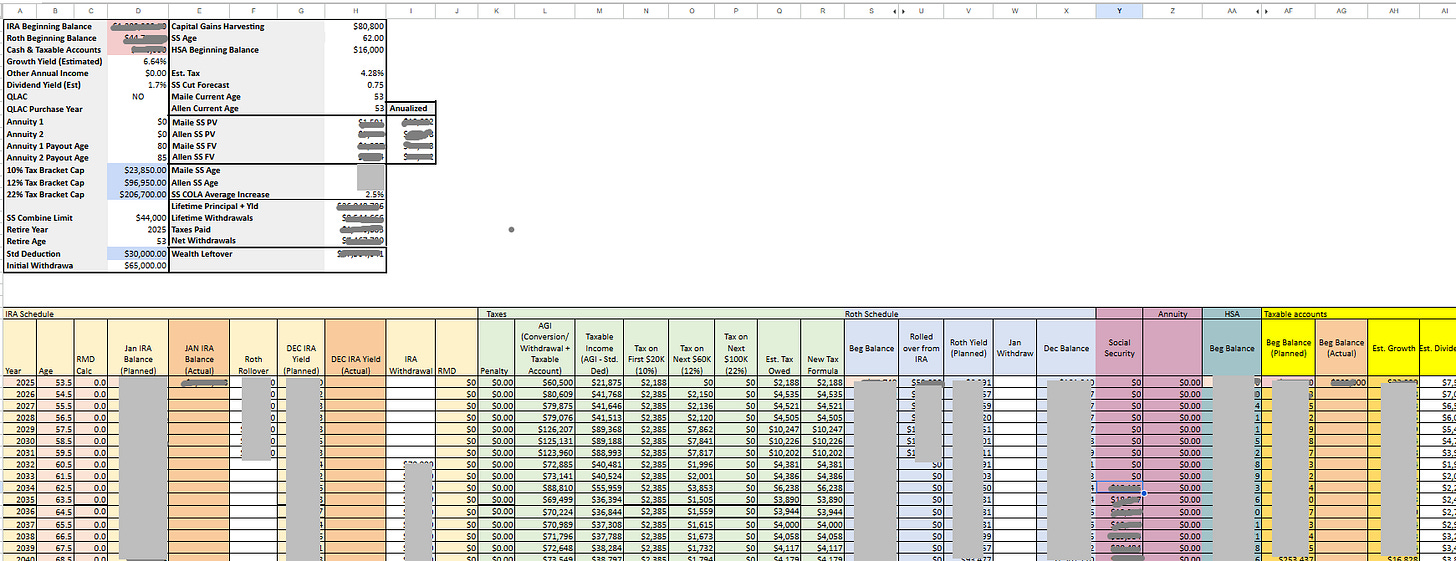

I don’t know if I’ve ever met a member of the FIRE community who didn’t have a massive spreadsheet with dozens of homegrown formulas calculating net worth, safe withdrawal rates, taxes, and various other “what if” scenarios about early retirement.

We are no different.

It started simple. A place for our net worth and a rough calculation of our safe withdrawal rate.

But then, we wanted to model ROTH IRA conversions, so we created cells to divide our net worth between tax-deferred, taxable, and ROTH brokerage accounts.

But then, we needed to know the tax consequences of the conversions, so we created formulas to mimic our progressive tax structure.

But then, we needed to factor in social security, which is taxed differently, so we adjusted our already complex tax formulas.

But then, we needed to balance tax efficiency with ACA subsidies, so we created formulas to calculate our modified adjusted gross income (MAGI).

But then, but then, but then…

It’s a thing of beauty. We’re proud of it. It’s our financial “wooby” that we clutch tightly for comfort and reassurance during financial storms.

But it’s also a nightmare to maintain, and most important, it only knows what we know. We’re the ones who created it. We make the rules. It can’t give us any insight into our own financial blind spots.

Enter Boldin, which used to be called New Retirement, which I think was probably a better name. It’s a web-based platform that does everything my amazing spreadsheet does and a lot more.

This isn’t a how-to post for Boldin, but here is a video tutorial from the White Coat Investor if you want one. This also isn’t a paid promotion. You can use something like ProjectionLab for roughly the same price point, and I bet it’s just as cool.

Here are three things Boldin showed us, that our spreadsheet did not.

I’m not immortal?! Why wasn’t I informed of this?!

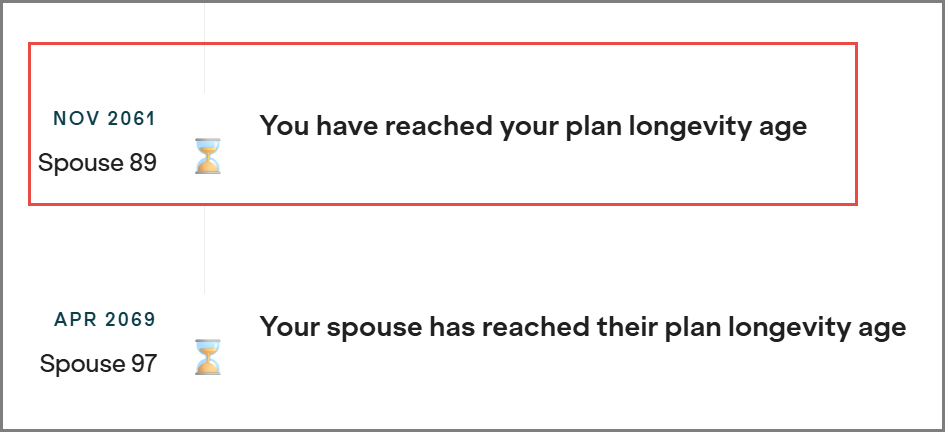

One of the first things Boldin did was model that I will die approximately eight years before my wife. Sobering to think about, but probably more accurate than our spreadsheet, which optimistically has us both living to 100.

Beyond making me put down that third chocolate chip cookie, there is useful information to be had in this morbid little revelation. Notably, my wife will pay more taxes as a single-filer.

I have a couple of learnings here.

My spreadsheet was optimized for the first ten years of retirement, because we’ve been told to worry about sequence of return risk*.

Boldin helped train my eye to the last ten years of retirement, where long term care expenses potentially skyrocket, and the widow trap is a real thing.

It turns out, the widow trap has nothing to do with spiders. A surviving spouse’s income goes down after losing the lesser of two social security checks, but taxes and Medicare costs go up due to the shift in filing status from married to single.

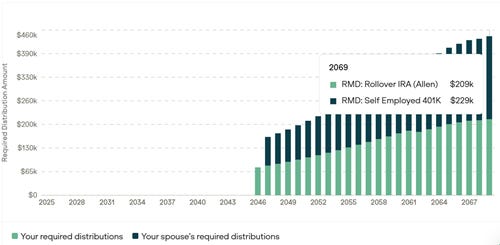

We won’t avoid required minimum distributions (RMDs), and that’s probably ok.

I remember being quite confident that we would just neatly convert all of our IRAs over to ROTH accounts and never have to worry about all of this RMD nonsense.

When I wrote about our ROTH conversion plan in October of 2022, we were near the bottom of a bear market. Since then, the total market index, our largest investment, is up more than 66%.

Our IRAs have grown faster than our spreadsheet said they would, and our planned ROTH conversions just aren’t big enough to keep up.

Why were our projected returns so conservative? Once again, we were too heavily focused on the first ten years of retirement and that pesky sequence of return risk. We wanted to model our retirement under the most pessimistic market forecast.

Boldin uses more realistic average returns, and again reminds us that we have a 35 to 40-year retirement horizon, not just 10.

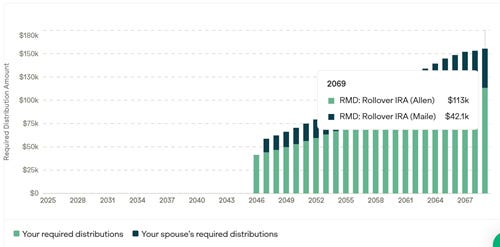

In our baseline scenario below, we modeled a retirement without any ROTH conversions. By the time my wife is 97 (remember, I reached my plan’s “longevity age” 8 years ago), she will be required to withdraw more than $400,000 from our IRAs.

However, if we model a scenario where we do approximately $750,000 in ROTH conversions over the next decade, her required withdrawals drop to around $150,000 at age 97. As an added bonus, our lifetime tax bill in retirement drops from about $1.3M to around $469K since most of our wealth will eventually be sitting in the ROTH account. We can live with that.

Income Related Medicare Adjustment Amount, a.k.a. IRMAA

Remember when we said that a weakness of our spreadsheet is that it only knows what we know? Well, we didn’t know anything about IRMAA and neither did our homegrown tool.

IRMAA is basically a fee you pay if you are on Medicare and your income is too high.

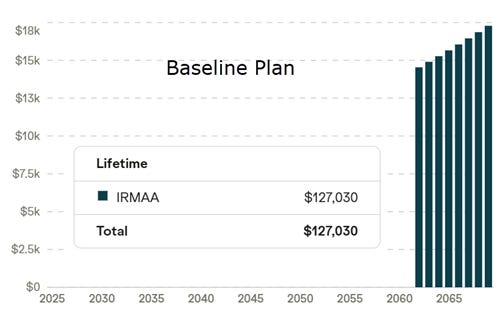

Under our baseline scenario, my wife will owe approximately $127,000 in IRMAA fees over the last eight years of her life. That’s less money she will have to spoil the pool boy.

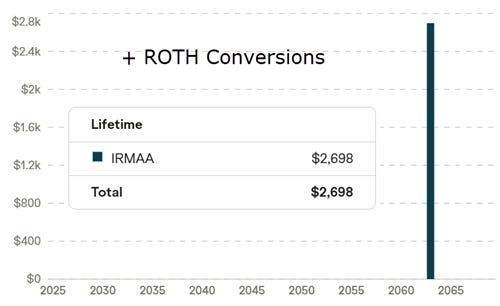

Under our ROTH conversion scenario, her lifetime IRMAA fees drop to about $2700; a savings of $124,000. Spend it wisely, Ramone.

Final Thoughts

There are other things Boldin can do that we are only just discovering. We’re particularly excited about modeling one-time expenses. For us, one-time expenses are an important part of our legacy.

We want to invite our kids and their families on a cruise, or maybe a big trip to Europe, and we want to pay for everything. Maybe we can help with the down payment on a house, or maybe set grandchildren up with college savings accounts.

We don’t just want to leave a legacy; we want to be an active part of our legacy.

Boldin gives us a clear picture of our ability to do that, and has certainly earned their ten bucks a month.

We will still occasionally use our custom spreadsheet, but like a classic car, it will remain parked in the garage most days and more appreciated than functional.

For just a little over 100 bucks for the year, its worth using the tool. With a good constructed spreadsheet (your image is close to what I built) takes into account IRMMA limits, Fill the tax bracket for Roth conversions, and social security income. Always good to get a second opinion

Eye opening!