Rich, Broke, or Dead

When deciding whether to retire early or continue working, we often worry about running out of money. Maybe we should worry about running out of time.

“Will I run out of money?”

This is a question that most of us ask when we are considering retirement, a sabbatical, or even leaving the salary and benefits of a good-paying job behind in order to start our own business.

If we turn to the web for answers, it spits out an endless list of retirement calculators.

All retirement calculators are not created equal. Some are overly simplistic, others are too complex. Nearly all of them are affiliated with companies that want to sell you financial products or services. This one from E-Trade focuses on portfolio growth, but it doesn’t allow you to adjust anything except the expected rate of return and your age. There really isn’t anything useful here.

One calculator that doesn’t try to sell you anything and contains a great deal of flexibility to test different scenarios is from engaging-data.com.

With this calculator, you can adjust your spending, savings, stock/bond/cash allocations, tax rate, and so on. You can add in extra income for a side hustle or when you become eligible for Social Security. You can also add some spending flex to your model, cutting some of the fat from your budget in the event of a market crash or recession.

Let’s look at the simulation for a conventional retiree based on a few assumptions. They want to spend about $85,000 per year in retirement. They have $1M in savings, allocated to 60% stocks and 40% bonds. At age 67, they will take Social Security, which will provide an extra $42,000 per year of income.

Based on these assumptions, there is about a 23% chance their portfolio is exhausted by age 85.

Reducing the anticipated spend to $75,000 per year gets this conventional retiree to age 90 with only a 7.6% chance of going broke.

With all of these parameters to play with, this retirement simulator can become a bit like the Mirror of Erised. To paraphrase Albus Dumbledore, “This tool will give us neither knowledge nor truth. People have wasted away before it.”

To say it plainly, this is a simulation and a thought exercise, nothing more. There are no guarantees that past market returns will equal future market returns. And we can spend hours in front of it, playing endless “what if?” games to try and get our I’m Broke percentage down 0%.

Fixating on the I’m Broke percentage has caused many a would-be retiree to fall ill to the One More Year Syndrome.

2018: “My numbers look pretty good, but I could still go broke in my eighties. If I just work one more year then I’ll have a bigger cushion.”

2019: “We’ve been in this bull market so long. A crash is coming. I still see a sliver of red in my nineties. I’ll just work one more year for a little more cushion.”

2020: “Covid is getting really serious. I’ll just work one more year to see how this pans out.”

2021: “I have a lot of responsibility at work, and I get to work from home now. I can’t just leave. I’ll give them one more year.”

2022: “Oh, this definitely looks like a recession. Inflation is out of control! My chance of going broke in my eighties just shot up because the market is down. I’m going to work one more year.”

There is one more parameter that I neglected to turn on for our conventional retiree - the mortality table. The uncomfortable, but useful feature of the Rich, Broke, or Dead Calculator is its prediction of whether or not we’re dead.

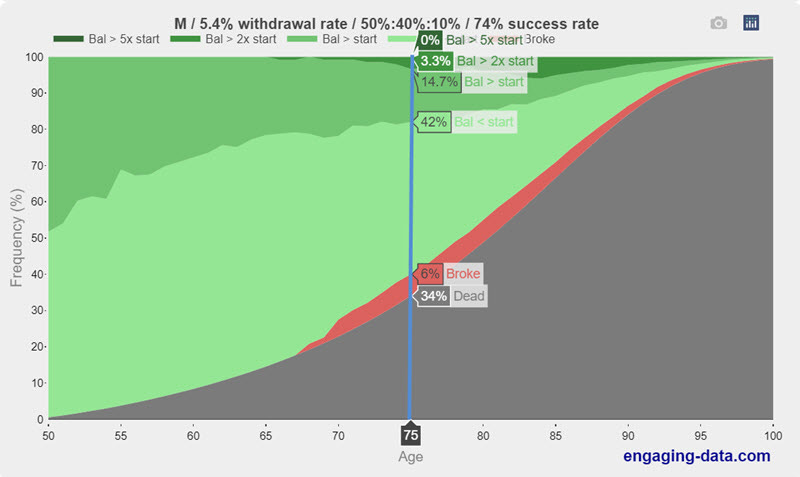

To illustrate this feature, I’m going to use my own simulation as an early retiree.

Me: “Oh! At my current saving and spending levels, there’s a 6% chance I will run out of money when I’m 75! Maybe I should work an extra 5 years to get that down to 0%?”

The Rich, Broke, or Dead Calculator: “Um, Allen? When you’re 75, there’s a 34% chance you’re dead. My advice to you is to hang onto those 5 years like grim death! Err, sorry Allen, that’s probably a poor choice of idioms.”

Time is our ultimate asset. No matter how rich we are, we can’t make more of it. What we can do, however, is become more intentional with the time we do have. For me, that means spending more time with my family or traveling to experience new things. Someone else may love what they do and want to keep working. Yes, you have permission to become financially independent and continue working. Others may want to finally turn their great idea into a business or finally fix that old motorcycle in the barn and then take it to Sturgis.

Time is more valuable for me at age 50 than at 75. At age 50, I can still walk the Camino de Santiago or the hilly, mosaic-paved streets of Lisbon. These are experiences that I don’t want to try and compress into two weeks while an ever-growing inbox awaits me on my return to work, and they are experiences that will be more difficult for me as I age (if I get to do them at all).

But the 6%, Allen!? I have some control there. There are things I can do during retirement to earn a little more side income or cut a little more spending. Even cutting $5,000 in expenses per year drives that 6% broke rate down to zero. Maybe I would get a part-time job if something catastrophic happened. On the day I retired, no one forced me into a black van and threatened me to never work again.

Retirement calculators are not crystal balls. The good ones, however, can be helpful to begin your own thought exercise about your money and your life yet lived.