Our 2022 Year-End Money Moves; November Spending Update

Year-end travel rewards, parasite removal, tax-loss harvesting, and office plants that deserve to die

It has been a strange holiday season so far. Usually, around this time, I am in negotiation with my working peers on how to split up on-call coverage over the holidays.

Sometimes, the negotiation was conscientiously passive-aggressive.

“Hey, Gina. If you can be on-call on Christmas day, I can take on-call New Year’s Eve. Yes? Thank you! We all know how much you like to drink.”

But sometimes, the negotiations degraded into downright animosity and threats of herbicide.

“Stop avoiding me, Clarence. Didn’t you take the week off after Christmas last year? It’s my turn! What’s that? You’ve already booked airline tickets? Listen, you twit - you’re working or I swear, I will walk right through that little warning note pinned to your stash of Diet Coke and caffeinate that stupid little plant on your desk until it withers and dies!”

Needless to say, it has been a rare holiday where I’ve been fully engaged with my family. Relax, I didn’t kill any plants (but I did drink his Diet Coke).

This year, with my new-found time, we were actually able to send out real Christmas cards for the first time in years - unlike previous holidays, when I would have to smooth things over with a joke on Facebook.

Year-End Money Moves

Beyond Christmas cards, we are spending time going full Marie Kondo on our finances for this year and next.

Credit Card Churning

Most of our large expenses occur at year-end (property taxes, home & auto insurance, etc.). Our goal is to always pay for these expenses with a couple of new credit cards that pay us back with large sign-on bonuses (either in the form of travel rewards or cash). This year, we earned 100,000 Marriot points (plus one free hotel night per year), along with 100,000 Citi rewards, all for simply paying our normal bills.

We always pay our credit card balances in full; this would be a stupid strategy if we didn’t.

We only pay for things we would buy anyway; we don’t go out of our way and buy stuff we don’t need just to meet our minimum spend.

Those card annual fees can really add up, so we track renewal dates closely and cancel old cards before they hit their renewal date.

We don’t waste points - we use or transfer our earned rewards balances before we cancel them.

If you want to learn this game, there are way better resources than my blog to get educated. I would recommend starting with the ChooseFI Ultimate Guide to Credit Card Travel Rewards.

Last thoughts on credit card rewards - we are lazy with this game.

Some people are really amazing at extracting maximum value from their rewards. Not us. We are pretty inefficient.

When we get a lot of rewards, we use them. We don’t give a lot of thought as to whether we are getting a value of 1 or 2 cents per point, or whether our use of points is a particularly good deal.

Even the lazy, inefficient Valentines have managed to accumulate nearly 700,000 points just by paying for everyday needs.

The lazy, inefficient Valentines have taken low or no-cost trips to Spain, Mexico, and Arizona in the past few years all thanks to a half-assed approach to credit card rewards.

Goodbye Bank of America, Vanguard, and ETrade; hello Fidelity

We are beginning to consolidate our banking, taxable brokerage accounts, and IRAs under Fidelity Investments. Last year, to calculate our net worth, I would have to log into five different financial institutions to check balances. I’m over it.

Peeling off all of those little wealth-draining parasites

We live in a parasite-based economy. Companies thrive on our collective laziness and inattention to detail. It’s an economy of hidden fees, little-used or forgotten subscriptions, and extended warranties.

December is our month to comb through our financials and rip off any little wealth-sucking ticks that have attached themselves along the way.

I had a subscription to the NY Times Crossword. I’ve done maybe 4 crosswords in 2022, so that’s gone.

I noticed our Hulu subscription had crept up to more than $20 per month. I switched to the Disney+/Hulu bundle (with ads) for around $10. We get an extra channel at half the cost (and I really don’t mind the ads).

I found an old domain and hosting service I wasn’t using (hey kids, thelastbrownie.com is now available if you want to start a food blog or something). It was about to auto-renew, but I turned it off in the nick of time, saving about $170.

One auto-renewal I failed to spot was a subscription to the Washington Post. We were charged $120 in November for the annual renewal. I don’t get a lot of value from WaPo personally (frankly, I forgot I had the subscription at all). I turned off the auto-renewal immediately after receiving the charge.

The WaPo subscription is a perfect example of our parasitic economy in action.

Offer a low introductory fee (if they pay annually), and watch as your customer gets consumed by life and forgets about it. Auto-renew them at the full price thereafter.

Tax-loss harvesting

2022 has been a down year for the market, and so we are making the best of that situation by rotating out of some stocks that have been duds and re-deploying that cash to other investments. This lets us offset some of our capital gains from investments that did well and lower our taxable income.

Because 2022 has been such a stellar year for equity losses in the Valentine household (*takes a bow* thank you… thank you, ladies and gentlemen), we should be able to harvest enough losses to lower our tax bill for the next few years.

I know what you’re thinking.

Allen, you’re just so brilliant. How can *I* also learn how to lose money in the stock market, and then somehow chalk that up as a win come tax time?

My favorite breakdown on this subject is Tax-Loss Harvesting from the Mad Fientist.

Tax preparation for 2023

We’ve begun estimating our taxes for 2023.

The bad news is that with my W2 job in the rearview mirror, our income will be cut in half in 2023. The good news is that with our income cut in half, our tax bill in 2023 will be one-tenth (1/10) of what it would be in a normal year.

One-tenth? Why not half? Half the income, half the taxes. What am I missing?

That’s an entirely different article, but to keep it short - our taxes will be 1/10 their normal size largely because we’re able to defer a larger percentage of our income to tax-advantaged accounts (e.g. IRA, solo 401k) due to the way the tax code favors investment and business ownership.

The other good news is that even with our income cut in half, we still expect to continue building on our investment portfolio at 75% of our normal velocity. In fact, the tax code demands it, if we are to leverage all of these savings.

November Spending

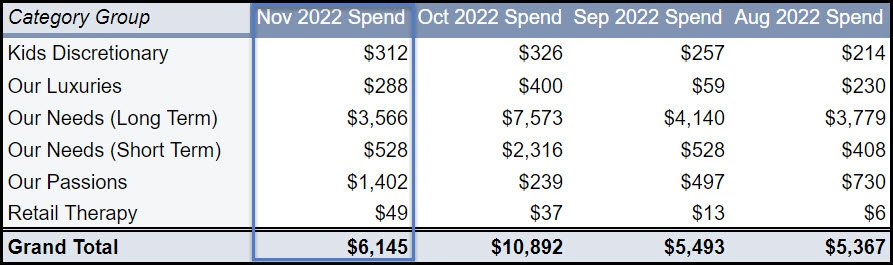

We’re still up a bit overall from our ~$5400 average, but we don’t expect things to settle down until after the holiday.

Our Needs (Long Term) came back down to earth in November after soaring in October to cover our annual home insurance payment. We expect December to look more like October as we pay our annual property taxes and our semi-annual auto insurance.

Our Passions spiked this month, which we see as a big win. It means we are dedicating more of our available dollars to things we care about most. In this case, we paid for tickets to CampFI to learn some new skills and make new friends in the personal finance community.

Final reflections on 2022

I have been reading Quit, The Power of Knowing When to Walk Away, by Annie Duke (author of Thinking in Bets), in preparation for a breakout discussion at an upcoming CampFI. Duke shares the idea that we humans are not so good at knowing when to walk away from something that isn’t serving us.

Culturally, we celebrate grit, perseverance, and a never-say-die attitude. We are all the Rocky Balboas of our own movie, refusing to back down in the face of all obstacles. But sometimes this is to the detriment of our physical or mental well-being.

Duke’s book isn’t about “giving up.” It’s about our tendency to stick with things for too long that truly aren’t serving us. This could mean doubling down on an investment gone bad, remaining in a toxic relationship, throwing more time and energy into a project that is off the rails, or remaining in a job where you aren’t growing.

Sometimes, it serves us better to demonstrate Quit, not Grit; to cut our losses and devote our energy and resources to other things.

I made the decision to leave my job this year because it was no longer serving me, nor was I serving it. Lacking growth, professionally and personally, I became burned out and my motivation tanked.

In the 6 months since leaving, I have rekindled a passion for writing, and have taken on various other projects. I don’t regret my decision. It was right for me, and it was right for the company.

Why I didn’t “quiet quit”

Quiet quitting or doing the bare minimum was never an option. It sounds boring, quite honestly. I am not, nor have I ever been “anti-work.” I like to be fully engaged. If I’m not feeling that, then it’s time to move on. I’m in a better place now than I was, and I don’t think I could have gotten here without quitting.

Thank you 2022 for all you have given me and mine. I regret nothing.

Thanks Allen. Great info. Unfortunately, we.are retiring at the most common age of mid-60s but that's ok. However, there is definitely a learning curve involved. Researching Medicare advantage plans, how to transfer 401k monies into an IRA after retiring from our current employer, how much to withdrawal each month to live on & what will the anticipated taxes be, signing up for SS, Just so much to learn and figure out. But...I am so looking forward to finally be at a place where we no longer work for someone else every day. We just had a 12'x30' shed delivered yesterday. Instead of taking money from savings to pay for it, we took a signature loan and will make the scheduled payment, plus pay a sh*t ton towards "Principal Only" to have a 36 month loan paid in full in approx. 10 months. Will have paid a little bit in interest, but our principle will have still been in the bank in case it was needed. Keep up the great work and Merry Christmas to you and yours.